Summary

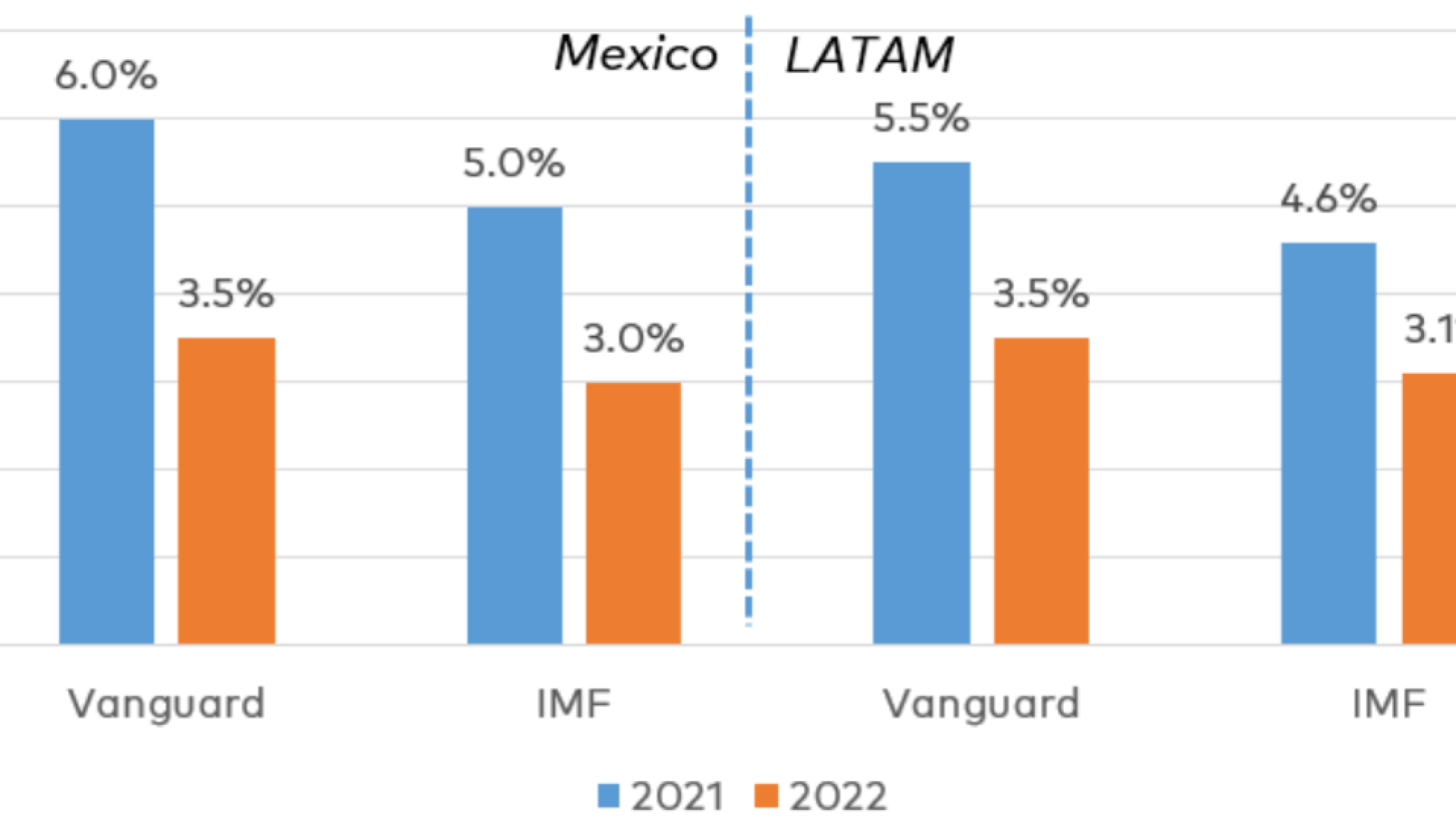

We are expecting Latin American economies to grow by 5.5% in 2021 compared to a world growth expectation of 6.1%. Despite the growth expectations for Latin America, it is not enough to close the output gap caused by the worst regional contraction in 2020 of -7.0%.

Source: Vanguard and IMF

The Mexican economy has performed broadly in line with our expectations so far in 2021. On the growth front, we have revised our above-consensus growth estimate higher to 6.5% for Mexican GDP growth in 2021, reflecting our improved US economic out look. The drivers of Mexican growth, strong US demand and an improving pandemic situation, are trending stronger this year. On the inflation front, while we had warned about stubbornly high core inflation, we had expected Mexican inflation to moderate more than it hasto dat e.

Monetary policy makers have responded with a rate hike in Mexico. Many EM peers, including in LATAM, face similar monetary policy pressures of rising inflation and rising US rates in the near term, prompting many EM central banks to hike recent ly. In terms of FX, we continue to hold on to our call from the beginning of the year for a stable peso at 20 MXN/USD due to balanced risks to both the up- and downside. The Mexican Central Bank (Banxico) has shown its willingness to counteract depreciating threats to the peso with monetary policy interventions. Upsides to the peso stem from strong global growth as Emerging Markets economies finally receive sizeable vaccine doses throughout the second half of 2021 and into 2022.

For 2022, we remain above consensus in our growth outlook as we think the world stands a good chance of achieving something close to global herd immunity in late 2022. This will benefit Emerging Markets economies the most via a global growth upswing. However, risks to EM growth, including Mexico and Latin America, stem mainly from global and US inflation and the USFederal Reserve (FED) actions. While we point to upside risks to inflation, we are in line with the FEDoutlook for rate hikes in the US and do not have earlier liftoff asourbase case. As a result, we think there is a sizeable upside risk to growth in Latin America from a steady economic growth environment with receding inflationary pressures and improved health outlooks.

Growth

The drivers of Mexican GDP growth in 2021 remain unchanged from those that we highlighted in our 2021 outlook at the beginning of the year, namely a strong external demand shock from a rapidly expanding U.S. economy, as well as improving domestic situation as the health outlook brightens thanks to vaccines . However, what has changed is the timing and magnitude of those drivers. As a result, we have increased our growth forecast for 2021 to 6.5% up from 4%.

For one, the U.S. growth impulse will be larger than what we had forecasted at the beginning of the year. Despite being above consensus with the original forecast in January, we have since upgraded our U.S. forecast to 7.5% growth for 2021 up from 5.5%. This will positively impact Mexican growth via the export channel, as roughly three quarters of Mexican exports are sold to the U.S. market. Secondly, the US growth impulse came a bit earlier than we had expected, due in almost equal parts to a fast vaccine rollout as well as the passage of the American Rescue act in March.

We remain above consensus for Mexican and LATAM growth in 2022 as we think vaccine rollouts across the region will surprise to the upside. Pfizer and Moderna alone have targeted 6 billion doses in 2022. As first movers such as the US, EU, China and the UK will have saturated demand, much of those doses will be destined for EM countries in the second half of 2021 and in 20 22.

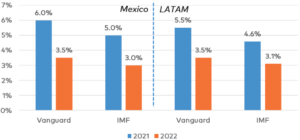

Consensus growth for the largest LATAM economies represent a bounced back from the economic drop from 2020 with expectations to trend down for 2022.

IMF growth prospects for Latin American economies

year-on-year real GDP growth

Source:IMF

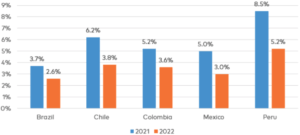

Inflation

Mexican core inflation hassurprised to the upside so far in 2021. We still expect inflation to moderate in the near term, but LATAM policy makers are increasingly aware of stubborn core inflation as witnessed by the recent interest rate hike by the Bank of Mexico (Banxico) as well as the Central Bank of Brazil.

We warned in our 2021 outlook that while a relatively benign headline inflation rate might give Mexico some room to cut rates at the beginning of the year, a stubbornly high core inflation rate that continued from 2020 into 2021 would concern policy makers. In fact, that concern has materialized so far this year. Mexican core inflation hascrept up above 4%. More importantly, the recent annualized trend in month-over-month inflation is at levels not seen in many years absent a spike in 2016. Alongside a more hawkish tone struck by the US FED at their June meeting, stubborn core inflation is likely what Banxico reacted to when they hiked rates at

their own June meet ing. While Brazil is seeing core inflation above its pre-pandemic trend since the middle of 2020, other LATAM economies do not need to concern themselves with core inflation at the moment.

However, while not all EM economies are experiencing inflationary pressures, global inflation is increasingly synchronized. We still expect inflation to moderate from current highs in the near term as short term supply demand constraints resolve . Yet there is an increased risk of persistently higher global core inflation in 2022 and beyond.

Mexican and Brazilian core inflation higher than pre-Covid

%, 3-mont h average annualized MoM inflati on

Source: Refinitiv, Vanguard Calculations

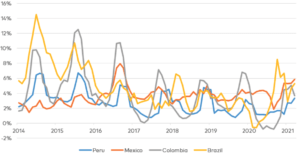

Some central banks in LATAM are under pressure to raise rates due to US fiscal expansion and rising inflationary pressures. Brazil and Mexico have reacted with rate hikes so far this year.

Mexico and Brazil hiked rates so far this year

Central bank referencerate (%)

Source: National Central Banks via Refinitiv

FX

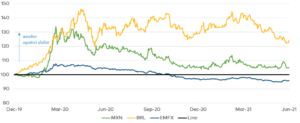

The Mexican Peso (MXN) has been relatively stable throughout 2021 so far at around 20 MXN/USD. This is what he had expected given the balance of risks we called out in our 2021 outlook at the beginning of the year. Our opinion remains that the risks to MXN are balanced and thus would expect MXN to remain stable through year end.

MXN has been a standout performer among EM peers since the pandemic-induced sell off in March 2020. This is a result of the upside pressures from strong demand for MXN due to export growth driven by a resurgent U.S. economy, as well as policy makers that arereluctant to take many monetary and fiscal policy liberties in order to protect the

value of the currency. In practice, that means comparatively conservative fiscal policy and higher than required central bank reference rat e. Downside risks to the currency remain a taper tantrum triggered by the FED raising rates and tapering asset purchases sooner and at a faster rate than expected.

We still view those upside and downside risks as relatively balanced, particularly as Banxico has shown its continued willingness to preempt any FED tightening intentions with actions aimed at stabilizing the peso. Banxico put rate cuts on ice in Q1 and even hiked rates at their recent June meeting, stabilizing the MXN . Should inflationary pressures abate in the US and the FED timeline for hikes moves back out into late 2023/24, we could even see some upward pressure on MXN as improved growth drives the peso higher. For now, we maintain our view of a stable MXN at -20 throughout year end.

MXN sensitive to FED communication but broadly stable against USD in 2021

EM Currency/USO, Jan ’20 = 100

Source: Bloomberg, Vanguard calculations. EMFX is the MSCI global currency index

Debt

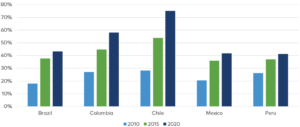

Debt across most LATAM economies increased as a result of the Covid-19 pandemic, but has generally been on the rise over the past decade. In our 2021 outlook, we forecast a modest increase in debt to GDPmeasures. In light of recent sovereign downgrades by major rating agencies in LATAM, a renewed focus is on debt sustainability.

Levels of external debt to GDPin LATAM are general slightly higher than EM peers . Major LATAM economies, Mexico and Brazil, look healthy on this measure. Mexico is cautious to raise too much debt in order to keep the value of the peso steady. We highlighted this in our FX outlook as a key reason for our stable MXN out look. Brazil has a relatively small amount of external debt and a larger local debt burden than this measure lays bare. Brazil’s ability to find a political solution to growing debt burdens continues to be a major focus for investors.

Some LATAM economies added substantially more external debt in recent years

Total external debt,% of GDP

Source:IMG via Refinitiv

Investment Outlook

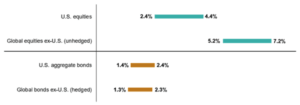

Despite rising equity valuations, the outlook for the global equity risk premium is positive given low bond yields. Investors worried about inflation risks could hedge their portfolios by including more equities and high inflation beta assets.

Our equity return outlooks are significantly lower-in some developed markets by nearly 2 percentage points

– as equity valuations have continued to rise. Our fixed income outlooks, on the other hand, have risen, largely in a range of a half to a full percentage point, attributable primarily to higher interest rat es.

U.S. dollar (USD) equity and fixed income outlook (10-year annualized nominal return projections)

Mexican peso (MXN) equity and fixed income outlook (10-year annualized nominal return projections)

Source: Vanguard

For matters pertaining to real estate in Puerto Vallarta, or real estate in Bahia de Banderas, property management, buying houses in Puerto Vallarta, buying condos in Puerto Vallarta or the surrounding areas Mexpat Realtors in Puerto Vallarta is a great resource call them or go to their website www.mexpatrealtors.com for more information