When people think of beach destinations in Mexico, two destinations immediately come to mind: Cancun with its Caribbean coast, and Puerto Vallarta with its choice section of Pacific coast. I did a lot of research on investing in Playa del Carmen, and Tulum, and I myself invested in real estate in Playa del Carmen. However, I was curious about real estate investment opportunities in Puerto Vallarta. So I took a flight to Puerto Vallarta and stayed there for two weeks to research the local real estate market.

Table of Contents

- Mexico has attractive demographics

- A large economy that has been growing steadily, but somewhat sluggishly

- A slightly disappointing current account for such a large manufacturer

- This is in spite of booming remittances

- However, Mexico is a country with very decent government finances

- However there are two massive trends that forecasters are not yet taking into account for Mexico

- In a world of natural resources supply shortages, Mexico is a prime producer

- Mexico has an economy that will muddle along, but with pockets of excellence

- However prices are already relatively high

- 4 key catalysts that make a real estate investment in Puerto Vallarta interesting

- Why I did not mention mainstream tourism

- In which region of Puerto Vallarta to make a real estate investment?

- Case study of a real estate investment on the long term rental market in Puerto Vallarta

- Case study of a real estate investment on the short-term rental market in Puerto Vallarta

- Case study of a real estate investment in the Zona Romantica, Puerto Vallarta

- Puerto Vallarta Real Estate Investment: Who is it right for?

- Conclusions on making a real estate investment in Puerto Vallarta

- Make sure to get in touch with Paul to make a real estate investment in Puerto Vallarta

Mexico has attractive demographics

With a fertility rate a bit above two children per woman, Mexico ranks higher than any Western country. It is quite visible when traveling around the country.

People tend to forget that Mexico is an absolute ogre population-wise with its 128 million inhabitants. It is the second most populous Latin American country after Brazil, with 210 million people, and well ahead of the third, Colombia with 50 million people.

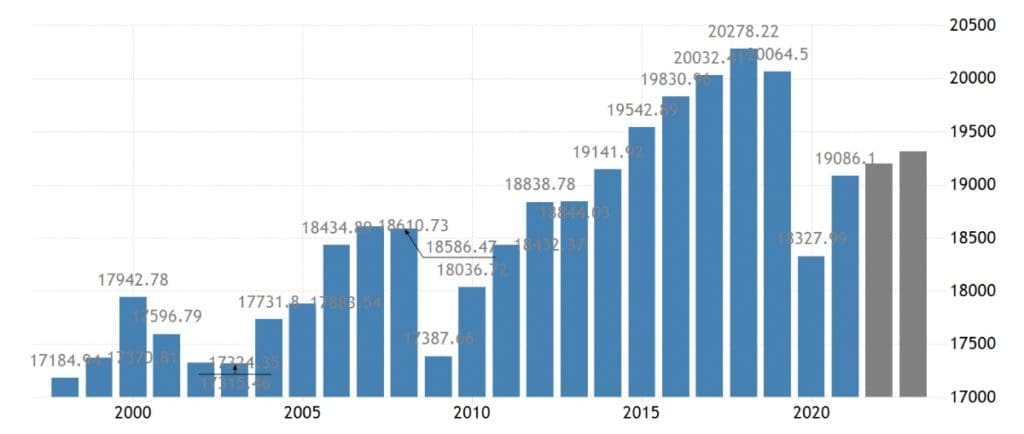

A large economy that has been growing steadily, but somewhat sluggishly

The most objective way to look at the country’s growth is on a per capita PPP basis, to capture how much people are really gaining from GDP growth.

Source: Trading Economics

These numbers are decent, but in all honesty they are a bit disappointing when taking into consideration the (mostly) free trade agreement with the US and Canada. A massive country with such a surplus of affordable labor, should objectively be doing better.

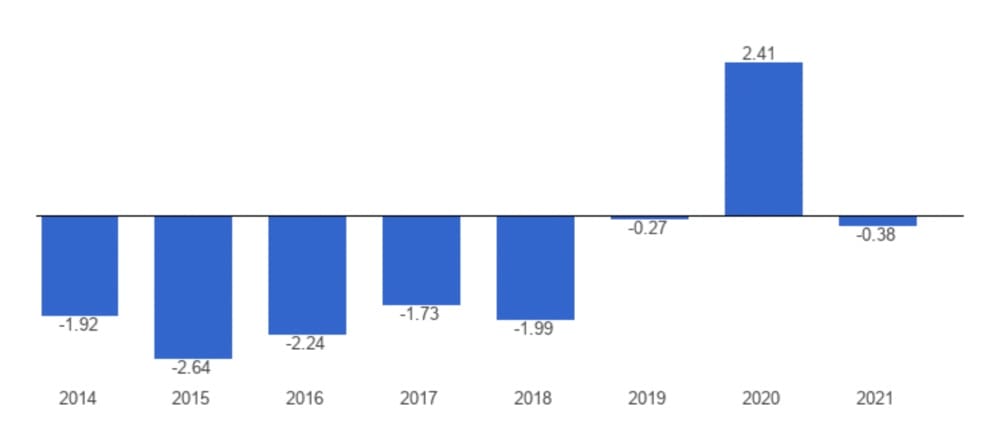

A slightly disappointing current account for such a large manufacturer

Source: The Global Economy

The 2022 and 2023 current account deficits are projected to be between -0.5% and -2% of GDP.

This is in spite of booming remittances

Remittances as percent of GDP . Source: The Global Economy

Remittances from Mexicans working in the US represent 4% of the Mexican GDP, and are a lifeboat for many families. Uncle Juan in Oakland is more of a safety net than the Mexican government. It also demonstrates the hard work of Mexicans in the US, considering the amount of Mexicans did not grow by such an amount proportionally over time.

Clearly, Mexicans in the US have been gradually moving up the food chain in terms of income.

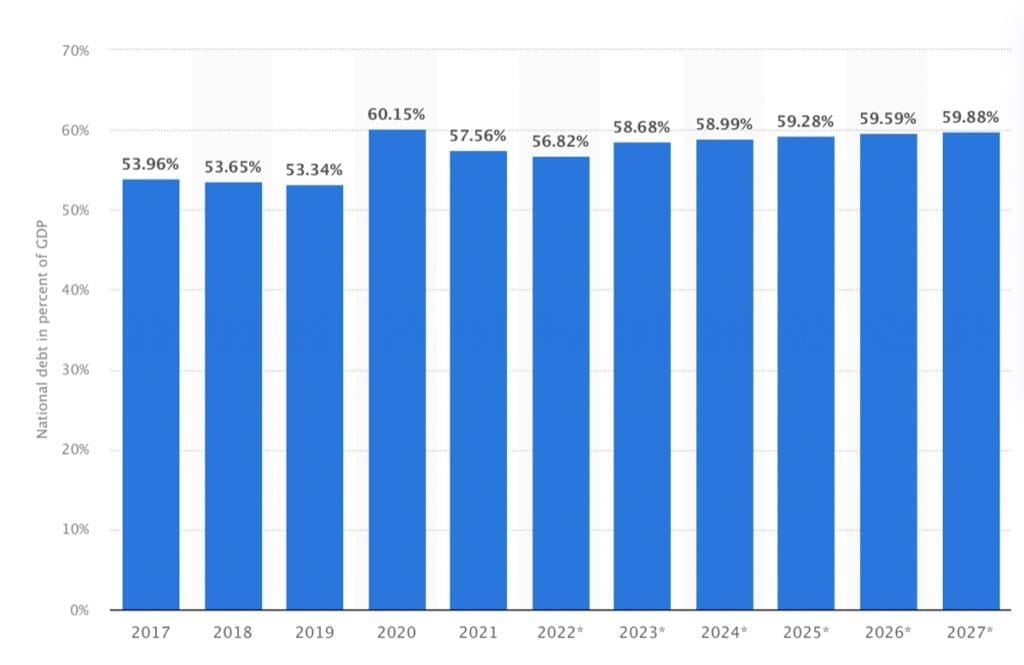

However, Mexico is a country with very decent government finances

In a world of government debt to GDPs in the Western world of mostly 100%+, Mexico’s figures are quite sobering.

Mexico: National debt from 2017 to 2027 in relation to gross domestic product. Source: Statistica

However there are two massive trends that forecasters are not yet taking into account for Mexico

The world is bifurcating between East and West, with a third, more neutral block in-between just as during the Cold War (Mexico is in this latter block).

The inevitable result of this drama is that re-shoring will become a top priority for Western companies and governments. After having outsourced most of its production of goods to China over the past 20 years, the US finds itself in a situation where it must re-shore production and reduce its exposure to China.

Manufacturing hubs such as Monterrey will benefit from re-shoring, and the industrialists will pour even more money into Riviera Maya real estate as they are already doing

The collective West installed a new sanctions regime – “If we don’t agree with you, we sanction you and seize your assets overseas,” which it did to Russia and its foreign reserves. China now knows how the collective West behaves and will seek to damage Western supply chains in case of increased tensions.

Whether they like it or not, Western companies will have to diversify away from China. A lot of this production will go to the likes of Vietnam, etc. But an obvious candidate is just across the border. Mexico will be in a prime position to benefit from this de-globalization and re-shoring trend massively. It is a huge catalyst that is not being considered by mainstream forecasters.

In a world of natural resources supply shortages, Mexico is a prime producer

This should greatly bolster Mexico’s current account deficit thanks to exports, and render Mexican industry more competitive.

Mexico is flush with natural resources. It is the world’s biggest silver producer and a top 10 miner of gold and copper, as well as lead and zinc. It is also trying to develop its energy-transition Lithium deposits.

Importantly, in spite of government efforts to increase environmental and regulatory checks & balances on mining operations, Mexico is the 4th biggest recipient of mining foreign direct investment (FDI) in the world.

Mexico’s energy policy is a mixed bag. It is a net crude oil exporter, but net importer of refined petroleum products, and a net importer of natural gas, though it has substantial reserves. It is the world’s 13th largest oil producer and has the world’s sixth-largest technically recoverable shale gas resources.

For many years the oil & gas industry was not prioritized, was nor incentivized to explore, and the large state-owned company PEMEX was used for political gain.

The government is now trying to heavily encourage oil & gas exploration. This is undoubtedly the right decision, but it will take time for results to be visible. The current energy crisis will absolutely be a catalyst for faster action.

But as often in its history, Mexico is also good at shooting itself in the foot. The government has been talking of nationalization of some natural resources, etc. Again, the headlines are scarier than the actual laws being passed, but it is nevertheless a net negative to be implementing such measures.

Overall, I believe that reshoring will be much more of a net positive than the negative elements linked to mining. I expect foreign direct investment to continue to be very strong in Mexico.

Mexico has an economy that will muddle along, but with pockets of excellence

I believe that Playa del Carmen and Tulum are two such areas of excellence. I discussed it a lot in my other articles, but after having spent two weeks here in Puerto Vallarta it is clear that Puerto Vallarta and its coast are the same. But before digging into the driving forces, I must say a few words on the mortgage market.

The mortgage market in Mexico is primarily for homeowners who live in their homes, rather than investment properties as the rates are really high (almost 9% and going up).

The advantage of investing in a market with a lot of leverage is that when times are good real estate values goes up a lot, but when times are bad, they descend with a vengeance.

This is a core advantage of making a real estate investment in Puerto Vallarta these days – prices are less likely to go down than in Phoenix, Vancouver, or Los Angeles. Both locals and foreigners who invest in this market are mostly cash investors.

However prices are already relatively high

Puerto Vallarta is by no means cheap if you want to buy an interesting apartment in one of the walkable areas. It’s more expensive than Mexico City, and together with Cancun, Playa del Carmen and Tulum, is the second most expensive area in Latin America after Punta del Este in Uruguay.

But unlike these other Latin American cities, prices are much more heavily linked to the North American market, as this is the main target market, as well as Mexican industrialists who are themselves very tied to the American economy.

So yes, absolute prices are expensive relative to the region, but it’s a completely different market.

Overall, I don’t feel that Puerto Vallarta is a market offering substantial capital gains. I rather see it as great diversification, a lifestyle play and a residency play in some cases. The cash flow from real estate is generally quite poor in Puerto Vallarta, but it is decent enough for people who want to spend time there, and rent out for the rest of the year.

I also believe that structurally, this market has less downside than most Western markets due to its cash nature, and its many catalysts.

4 key catalysts that make a real estate investment in Puerto Vallarta interesting

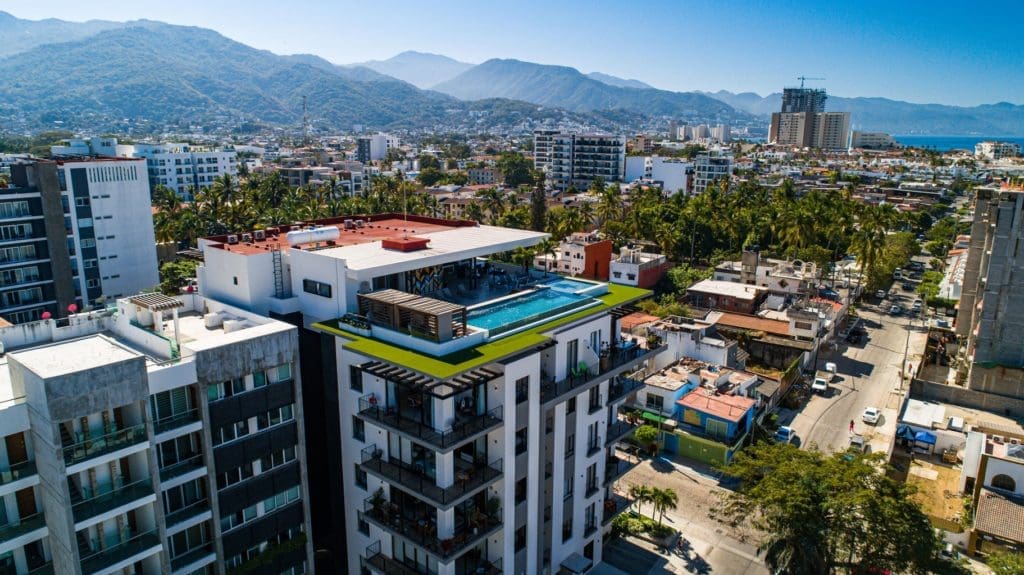

1. Staggering development in Puerto Vallarta

Puerto Vallarta International Airport

Puerto Vallarta International Airport

Puerto Vallarta airport is absolutely booming. In 2022 it was the Mexican airport with the most passenger growth versus 2021. Passenger numbers grew a staggering 51%, so much so that the airport is expanding. The main terminal is being renovated and a second terminal is being built. This will increase capacity, comfort, and drive even more volume of tourists and nomads.

The new terminal is expected to open its doors in late 2024, and is set to become Latin America’s first net-zero airport. The net-zero element is interesting in the sense that the city seems to be targeting higher-end tourism, which is more sensitive to such matters.

In the meantime, Puerto Vallarta airport storms ahead with Q1 2023 passenger numbers up 25% against an already eye-popping 2022.

New highway to GuadalajaraHuge catalyst

The government has been working on this highway for many years. It’s a massive catalyst from a local tourism point of view. Few foreigners are aware, but Guadalajara metro has a population of 5.5 million people.

These people previously had to travel over 5 hours each way. Soon they will be able to get to Puerto Vallarta in 3 hours or so. This will be a healthy boost for weekend tourism. As Mexico continues to develop thanks to re-shoring activity, the new Mexican middle and upper classes will be happy to go to the beach for the weekend.

Though this is bullish for Puerto Vallarta in general, it is even more so for small beach towns near the highway on the way to Guadalajara. More on this topic below.

2. Digital Nomads

The reality is that one short flight away from Puerto Vallarta is a massive market of high-earning Americans who simultaneously realized a few things:

- They can work almost entirely remotely.

- They can work from abroad, thus leaving behind an increasingly toxic environment. This perception of toxicity applies to Americans of all political stripes.

- They can live a quality life for less money abroad and in many cases can save on taxes if structured properly (feel free to get in touch with my tax consultants here)

Millions of Americans have either reached these conclusions, or soon will.

First-time American digital nomads will stick to the name brands in terms of travel destinations, which is bullish for making a real estate investment in Puerto Vallarta.

Puerto Vallarta is one of the world’s top digital nomad destinations, along with places like Chiang Mai, Playa del Carmen, Bali, Budapest, Tulum, and Medellin.

3. North American political and cost-of-living refugees

The influx has already started and is bound to grow. I am not referring to digital nomads who move here for a few months before bouncing off somewhere else. I am referring to people, of all political stripes and ages, who move down to Mexico full-time. They sometimes have online businesses, but often they still have businesses back home which someone manages for them, they are retired, they live off passive income, or start actual businesses in Mexico.

I have met a few types of such people:

Liberals who fear a right-wing dictatorship in America

I’ve met a few of those. They fear that they are gradually losing their rights in America (recent supreme court rulings) and that the country is just waiting for a radical turn to the right.

Conservatives who fear a left-wing dictatorship in America

They feel the federal government is after them, that the IRS will persecute people, and that their rights and freedom of speech are under attack.

Apolitical Americans who are sick of all the politics in America

They just want to live in peace away from all the nonsense. The beach in Mexico is a good destination for this.

Unvaccinated people

People who don’t want to get vaccinated and who feel they have more medical freedom in Mexico. They come in all political stripes; conservatives, health practitioners and hippies, not to mention many Canadians.

Europeans who flee conflict

Riviera Maya lately hosts an increasing number of Ukrainians and Russians, but not Puerto Vallarta as it is farther away from Europe and does not have many direct flights to the old continent. There aren’t many Europeans in Puerto Vallarta. For example many exchange offices will not even display Euro conversion rates as an option.

No € to be seen

Cost of Living refugees

As inflation eats away at people’s savings in Western Europe and North America, and as the healthcare systems gradually fall into decay (Europe and Canada) or become too expensive (America), many people will move down South where the cost of living is lower.

Granted, Puerto Vallarta is not the cheapest destination in Mexico, let alone in Latin America. But it is conveniently located, English is relatively widely spoken, and it is nevertheless affordable and comfortable. We can expect tens of millions of such Westerners to leave the West in the coming decades. Puerto Vallarta will attract many North Americans, especially as obtaining residency in Mexico is easy.

Investors must understand that not all such people are “cheap”. If you earn $70,000 in Illinois you can live a decent enough life, but in Mexico you will live very well.

4. Walkability is a true competitive advantage for the real estate investment market in Puerto Vallarta

Great walkability in Puerto Vallarta, not just the boardwalk but in town as well

This is one of the key selling points of Puerto Vallarta real estate compared to many other destinations in Latin America. The walkability of the city is great, not just on the famous boardwalk but in town as well. And as soon as you want to venture farther way, there are cycle lanes on the main arteries as well as a bus system that is easy to understand and use. It’s cheap, and you also see wealthy Gringos taking the bus because of how convenient it is. This contrasts with Playa del Carmen and Tulum where wealthy Gringos do not use the local bus network.

If you live in the center or near the center, Puerto Vallarta is very walkable. You can live a bit of a village life without having to buy or rent a car. In an age of inflation and high gas prices, this makes a difference. Also, for people who just want to stay for a few months, or plan to stay for a week on holidays, walkability is a key factor to avoid hassling with taxis.

Going to the nearby towns is easy as well with buses departing on a hourly basis.

5. LGBTQ

This again is a topic that gets people politically heated. Just looking at facts, whether you like it or not, the US and Canada are experimenting big shifts.

Gen Z self identifies at a rate of 20% as LGBTQ, versus less than 5% of boomers. This is a generational sea change.

Puerto Vallarta, and more specifically the Zona Romantica, is a world-renowned gay destination. This is a big growth market.

However, there is space for everyone. Venture outside of that area and you’ll meet plenty of Canadian families who fled what they perceive as LGBTQ ideology in the school system in Canada.

Mexico is a land of contrasts.

6. Safety

Puerto Vallarta feels very safe. Unlike in some other Latin American destinations, I wasn’t looking over my shoulders when walking around at night, and felt comfortable going out with an expensive phone without sticking it into my boxers.

Mexicans feel the same about Puerto Vallarta. They like its reputation for safety. I remember meeting a group of young Mexicans in their 20s from Mexico City. I asked them why they chose Puerto Vallarta for the weekend instead of Playa del Carmen. They replied that for Mexicans Puerto Vallarta is safer.

Insightful, and very positive for the local element of the local real estate investment market in Puerto Vallarta.

Why I did not mention mainstream tourism

Tourism is obviously the number one target market for your real estate investment in Puerto Vallarta with millions of travelers landing at the Puerto Vallarta airport.

However, we must not ignore the macro environment. The reality is that we are entering a world of expensive energy, which will mean more expensive flights and squeezed real incomes due to surging inflation all over the Western world.

This will not be without consequences. People that could once afford to go on vacation might not next year, or might go on vacation to Mexico for one week instead of two weeks. Such a macro environment is inevitably a net negative for tourism in most places in the world.

This being said, domestic Mexican tourism is gaining in strength, especially with the highway being built, and there are these other catalysts that should help make up for a loss of organic tourism growth. The new infrastructure will attract people who would not have come, and all these digital nomads and refugees of various types will help fill the properties of real estate investors in Puerto Vallarta..

In many cases tourism is a zero-sum game. A tourist has only X number of days to spend every year. You must remain attractive to stay ahead of the competing destinations.

In which region of Puerto Vallarta to make a real estate investment?

Making a property investment in the region

First, let’s start with the region, and we shall delve into the city and its neighborhoods a bit later.

Regional real estate investment heat map of Puerto Vallarta

I would totally ignore the coast south of Puerto Vallarta given that the regional development is more focused northward towards the highway and the expanding airport, two key drivers for the real estate market in Puerto Vallarta.

Marina Vallarta

This neighborhood is very comfortable for living. And many expats live here. Walk around any morning and the restaurants will be packed with North Americans having brunch. However, as a pure investment I avoid it due to one chief reason; the area has peaked. It’s nice, but there isn’t any further growth planned. It is starting to look a little old. It’s past its prime. Lifestyle? Yes. Investment? No

Nuevo Vallarta

Nuevo Vallarta is absolutely fascinating in the sense that you could forget you’re in Mexico if there weren’t so many Mexican workers around. It’s essentially a large, gated community with hotels, malls, private clinics, private schools, and its own prime beach. The infrastructure is great, though you must have a car as it isn’t pedestrian friendly in the sense that it is very big.

In some respects it’s a little kitsch (think fake Mayan pyramids), but in many ways it offers all the comforts of back home. You see Mexican, American, and Canadian flags everywhere. The supermarkets have imported products from back home. And it’s very safe.

I talked to a few expats here. They are quite different from expats in other parts of Puerto Vallarta in the sense that they seem to mingle a lot less with locals. For many it’s just a great beach destination, with great weather, safety, and affordable help and food.

As a pure investment I would stay away from it as it is already rather built out. You’re looking at easily $400 per square foot for new construction. I can find better value with more upside potential in other neighborhoods and nearby towns, with less HOA fees if I were to rent the property out.

Having said this, it’s a great lifestyle play.

Bucerias and La Cruz

Growing area. There is still much space for construction. The infrastructure is absolutely not “there” yet. Dirt roads, constructions sites, and the marina is not that appealing, nor are the boats premium. But this will change. The highway lays nearby and the airport is close so this area will definitely develop over time. I doubt the rental yields are very interesting for now, as living there without a car is not that appealing and many of the retirees and digital nomads would prefer to be somewhere livelier, but for capital gains this is probably not a bad play.

Punta Mita

Sorry, you’re late. Extremely expensive already. Lifestyle play. Very high-end developments, and extremely pleasant area with gorgeous views and decent infrastructure. It was even hard to take pictures of anything pretty because everything is behind the walls of luxury gated communities housing multimillion dollar properties.

Sayulita

Really cool surf village that has turned into Puerto Vallarta’s Tulum. Even in low season it is PACKED with young digital nomads. There is even a Selina hostel, which says much about the destination given how selective Selina are when choosing their destinations.

If you walk around Puerto Vallarta in the low season during the day it feels a little dead. However, in Sayulita the cafes are teeming with young digital nomads who pass their time working, drinking at cool bars, shopping in cute stores, hanging out at the beach or surfing the waves. It’s a fun year-round destination.

But real estate is already expensive. I don’t know how much more upside there is. Objectively, it’s not like you’d be getting in early on a trend. You missed it as a pure real estate investment. It’s a lifestyle play now.

San Pancho

The next Sayulita. If you want Sayulita-ish vibes at a discount with potential upside, this is where you go. It’s a mere 15-minute cab ride away if you want to go have fun in Sayulita every once in a while. If I had to invest I would rather do so here to capture more potential upside.

Lo de Marcos

If I had to speculate anywhere on the coast, it would be in this village. For now, there are still barely any tourists and the beach is pristine. The tourism infrastructure is almost non-existent, but it feels quaint as a result. If you bought something here, finding a decent Airbnb manager would probably be a bit challenging. You’d probably have to find a neighbor or one of the few expats living in town.

I believe that this village represents the best speculation and odds of strong capital appreciation. Development will inevitably arrive in this area, with the new highway being a big catalyst, as well as prices that went up significantly in Sayulita and San Pancho. Things can only get better in this village. It’s a decent long-term speculation.

I believe that Lo de Marcos will offer the most upside for real estate investments on the coast near Puerto Vallarta.

La Peñita / Ricón de Guayabitos

Relatively large ugly town targeting lower- and middle-income Mexicans. This would be a bet on the Mexican middle class, and the highway will make it even more accessible to Guadalajara. The beach is nice, but all the buildings in town look like they got their last remodeling done in the mid 90s. You find a few North American retirees on a budget living here.

Overall it would probably be a decent investment over the long term due to the highway and Guadalajara which keeps growing. But it’s certainly not a place you’d want to spend time in for now.

Making a real estate investment in Puerto Vallarta itself

In which neighborhoods to invest in real estate in Puerto Vallarta

Puerto Vallarta is now a city of close to 300,000 souls. Before making a real estate investment in Puerto Vallarta, it is crucial to have a good understanding of its key neighborhoods.

Centro

This is a classic area with the famous boardwalk, cobbled streets, boutique hotels, bars, clubs and art galleries. If you want to buy core location, this is the best that Puerto Vallarta has to offer. However, prices are expensive. It’ll be hard to make a decent capitalization rate on real estate investments in this area, however your occupancy rate will be very high. Overall I see it as a lifestyle play, with some of the best leisure Puerto Vallarta has to offer.

Even run-down houses are expensive. When I called to inquire about this house, it had already been sold for $230,000. It wasn’t a large plot of land either.

You can get a really nice 2 bedroom apartment in a historical building in core Budapest for this price 🙂

Zone Romantica

Known to be the best area in Puerto Vallarta, together with Centro. It’s a big LGTBQ destination, but only a small section of the area is dedicated to this crowd. You’ll also find plenty of retired North Americans, digital nomads, etc. I find that prices here are not cheap at all, as the video below will demonstrate. However, finding tenants is easy. Due to the price of real estate though, it’s hard to make high capitalization rates, and I don’t think you’ll be making amazing capital gains. The thesis here has already played out. As with the Centro, this is a lifestyle play which you can combine with being able to list the condo on Airbnb when you are not in town.

Fluvial

Just a normal residential area with an increasing population of expats who move there because of general affordability. It’s not particularly pretty, nor close to the beaches. Upside is limited here, as well as rental yields.

5 de Diciembre

Most digital nomads I met stay in this area because it is close to Centro, is more affordable, has good beach access, and is increasingly dotted with cute cafes and restaurants. This area is not cheap, but comes at a 20% discount to the centro. There is probably a bit of upside in this area still as businesses move in. It’s a convenient area and is where I stayed myself. But I find that both Versalles and Lazaro Cardenas offer more upside potential.

Versalles

I really like this area from an investment standpoint. Why? Because cute cafes and restaurants keep popping up, and people “in the know” are increasingly going for dinner and drinks here. It’s absolutely not on the tourist map, and is only really known by some people who live full-time in Puerto Vallarta. People living in the Centro and Zona Romantica now occasionally go to Versalles in the evening for dinner.

It’s a trend, but it’s still early in the game. The neighborhood doesn’t look great yet, and there are a lot of mean looking buildings. This, combined with its relative proximity to the beach and airport makes it a stand-out from an upside point of view. This is my favorite spot to make a real estate investment in Puerto Vallarta together with Lazaro Cardenas

Lazaro Cardenas

This area is one notch below Versalles. Not much is happening here, but the occasional nice new building emerges as well as the odd cute cafe. It is sandwiched between 5 de Diciembre with all its digital nomads and Versalles with its cool restaurants and bars. As Puerto Vallarta continues to grow, it is inevitable that Lazaro Cardenas will grow. For long term capital gains when making a real estate investment in Puerto Vallarta, this is a very good bet.

Zona Hotalera

As the name implies, there are mostly hotels in this section of town, though there are more residential towers than in the Cancun hotel zone for example. I wouldn’t buy there as an investment. Prices are high as it is and I don’t see much upside.

Case study of a real estate investment on the long term rental market in Puerto Vallarta

This two bedroom, two bathroom condo near Versalles is being sold for $449,000 fully furnished.

| Purchase price | $449,000 |

| Closing costs (+-6% notary + $2,600 for local trust) | $29,540 |

| Total purchase price | $478,540 |

| Yearly rental income $1,700 per month @ 90% occupancy | $18,360 |

| Administration / Property Management ($200 per month) | $2,400 |

| Yearly HOA / Common charges ($330 per month) | $3,960 |

| Property tax | $500 |

| Yearly maintenance allowance | $1,000 |

| Total yearly costs for a long term let | $4,260 |

| Net pre-tax income | $10,500 |

| Net rental yield and capitalization rate ($10,500 / $478,540) | 2.2% |

This is for the long-term market, which is absolutely not attractive. It would be better to put it on Airbnb and have the apartment available for when you want to use it.

Case study of a real estate investment on the short-term rental market in Puerto Vallarta

| Purchase price | $449,000 |

| Closing costs (+-6% notary + $2,600 for local trust) | $29,540 |

| Total purchase price | $478,540 |

| High season $150 with 75% occupancy for 5 months | $17,156 |

| Low season $95 with 60% occupancy for 7 months | $12,169 |

| Total gross yearly income | $29,325 |

| Administration / Property Management ($200 per month + 20% of turnover) | $8,265 |

| Yearly HOA / Common charges ($330 per month) | $3,960 |

| Utilities and internet ($200 per month) | $2,400 |

| Property tax | $500 |

| Yearly maintenance allowance | $1,000 |

| Total yearly costs for a long term let | $16,125 |

| Net pre-tax income | $13,200 |

| Net rental yield and capitalization rate ($12,034 / $478,540) | 2.8% |

This allows you use the apartment for parts of the year, cover all your expenses and still make a bit of cash flow.

Case study of a real estate investment in the Zona Romantica, Puerto Vallarta

Because rental demand is so strong in Zone Romantica, the rental yields are higher.

Puerto Vallarta Real Estate Investment: Who is it right for?

People who want to spend part of the year in Puetro Vallarta

Many people wish to mix lifestyle and a place they can rent out. Puerto Vallarta is a lovely lifestyle destination, right in the West Coast time zone. If people want to maximize their ROI, I recommend they list the condo on Airbnb from mid-November until the end of April, which is the peak season.

A real estate investment in Puerto Vallarta of a minimum of $220,000 using the right structure qualifies the investor for residency in Mexico. There are many other ways to qualify for residency in Mexico (more details here). Making a real estate investment in Puerto Vallarta is an easy way to qualify for residency in Mexico.

People who want to spend the whole year in Puerto Vallarta

Puerto Vallarta has shifted from a seasonal destination to a full-blown year-round destination. It’s a very pleasant place for both retirees and younger people. The fact that it is increasingly well-connected to the US and Canada makes Puerto Vallarta increasingly livable for people.

Westerners who want to spend time in Mexico and diversify without taking on too much geopolitical risk, in an established destination

People who want to diversify away from Western countries, without taking geopolitical risk. Mexico is unlikely to get involved in any war, and investments are welcomed from all over the world. In many ways it is a bit of a safe haven. Granted, Puerto Vallarta is not a cheap destination, but it is very established, and importantly comes with minimal currency risk on rental income as rents are set in USD, not in Mexican Pesos. The rental yields are not particularly attractive. It really is an investment destination for people who actually want to spend time there.

The fact that it is mostly a cash market also offers downside protection compared to Western markets and their rapidly rising interest rates.

Conclusions on making a real estate investment in Puerto Vallarta

When people think of beach destinations in Mexico, two destinations immediately come to mind: Cancun with its Caribbean coast, and Puerto Vallarta with its choice section of Pacific coast. I did a lot of research on investing in Playa del Carmen, and Tulum, and I myself invested in real estate in Playa del Carmen. However, I was curious about real estate investment opportunities in Puerto Vallarta. So I took a flight to Puerto Vallarta and stayed there for two weeks to research the local real estate market.

For matters pertaining to real estate in Puerto Vallarta, or real estate in Bahia de Banderas, property management, buying houses in Puerto Vallarta, buying condos in Puerto Vallarta or the surrounding areas Mexpat Realtors in Puerto Vallarta is a great resource call them or go to their website www.mexpatrealtors.com for more information.