Worried about Mexican home insurance being a gamble? Fear not! This “Mexpat Realtors Myth Buster” dives deep into the truth about Mexican home insurance. We’ll explore common misconceptions, like the idea that getting claims paid is difficult. We’ll show you how reputable insurers in Mexico operate with transparency and offer efficient claims processes. By the end, you’ll be equipped to find a trustworthy provider and secure reliable coverage for your Puerto Vallarta real estate whether it’s a house or condo.

Many people believe Mexican home insurance isn’t reliable. There’s some validity to that concern, but it depends. Basic home insurance might not cover everything you need, and there can be issues like inaccurate valuations, scams, or lack of add-on coverage.

The Key to Peace of Mind: Getting the Right Coverage

The good news? With some effort, you can get solid protection. Here’s how:

- Don’t settle for cheap: While tempting, a low-cost policy might have high deductibles, limited coverage, or be from a questionable company. Choose a reputable insurer with a proven track record.

- Read the fine print: Understand what’s covered and excluded before signing. Ask questions and get everything clarified.

- Consider a broker: A good broker can help you navigate options and find a policy that fits your needs and budget.

By being aware of potential issues and taking steps to get the right coverage, you can ensure peace of mind for your Mexican home.

Don’t Gamble with Disaster: Earthquake and Volcano Protection for Your Mexican Home

Don’t Play Roulette with Risk:

When it comes to protecting your Mexican property, underestimating the risk of earthquakes and volcanic eruptions is a dangerous gamble. Taking the time to understand and prepare for these natural disasters can save you a lot of heartache (and money) down the road.

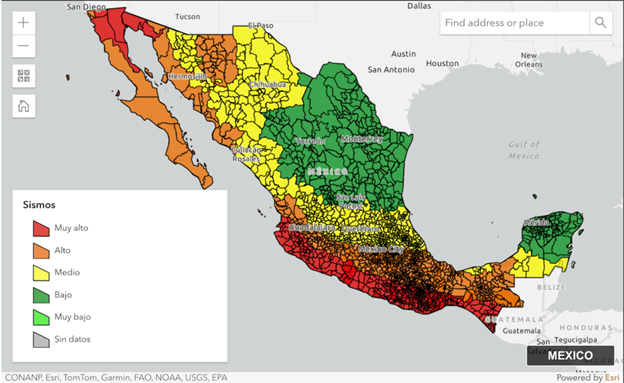

Mexico’s Seismic Zones: Know Your Risk

Mexico is divided into earthquake zones, with Zone A having the lowest risk (no activity in 80 years) and Zone D experiencing frequent, high-magnitude quakes. Standard home insurance often excludes earthquakes, so additional coverage is crucial if you’re in Zone B, C, or D. (Most of Nayarit is Zone A, most of Puerto Vallarta is Zone B, the South Shores are Zone C)

ThinkHazard.org says For Puerto Vallarta, earthquake hazard is classified as medium according to the information that is currently available. This means that there is a 10% chance of potentially-damaging earthquake shaking in your project area in the next 50 years.

Earthquake Coverage: Protecting Your Investment

Adding earthquake coverage will provide a safety net in case of a seismic event. The cost varies depending on your zone and insurer, typically ranging from 80% to 120% more than the base premium. Be prepared for higher deductibles and coinsurance with this add-on. However, some companies offer policies with no deductibles or coinsurance, although these come at a steeper cost.

The Takeaway: Peace of Mind is Priceless

While earthquake and volcano coverage adds to the initial cost, it’s a small price to pay for peace of mind. By understanding your risk and exploring coverage options, you can ensure your Mexican home is protected against these natural disasters.

Source: http://www.atlasnacionalderiesgos.gob.mx/

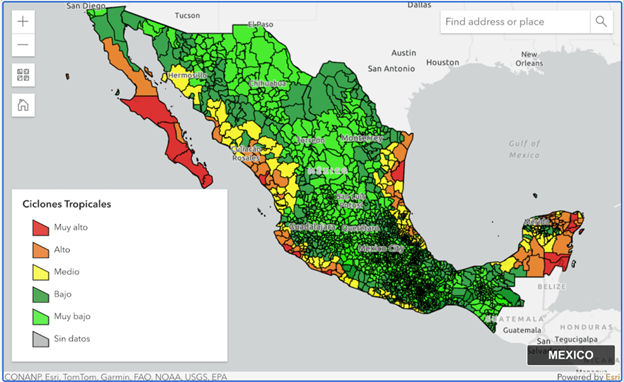

Don’t Get Swept Away: Flood and Hurricane Protection for Your Mexican Home

Weather the Storm with Added Protection:

Hurricanes, tsunamis, and other weather events (hydrometeorological phenomena) pose serious threats to Mexican properties. Here’s the catch: basic homeowner’s insurance typically doesn’t cover them.

Why Consider Additional Coverage?

While you might think, “Hurricanes and floods won’t reach me,” consider the hidden dangers. These powerful events leave devastation in their wake, with debris causing significant damage even if your property directly escapes the wrath of the storm.

Investing in Peace of Mind:

Adding hydrometeorological coverage provides a safety net. Similar to earthquake coverage, the cost varies by zone and insurer, ranging from 60% to 100% more than the base premium. Expect higher deductibles and coinsurance with this add-on, though some companies offer options with reduced or no deductibles for a higher cost.

The Bottom Line: Be Prepared

The additional cost for flood and hurricane coverage is an investment in peace of mind. By understanding your risk and exploring coverage options, you can ensure your Mexican home is protected from the destructive power of nature.

Source: http://www.atlasnacionalderiesgos.gob.mx/

Honesty is the Best Policy: Avoiding Coverage Issues with Accurate Declarations

Just like any insurance, home insurance in Mexico hinges on honesty. Providing inaccurate or false information is a serious offense and can even lead to legal trouble. Here’s a common scenario:

Living by the Water?

Mexican law defines specific distances for properties near water bodies (oceans, lakes, lagoons, rivers, swamps). If you have a waterfront property with multiple structures, the closest one to the water needs to be:

- 500 meters from the high-tide wave break for oceanfront locations.

- 250 meters from the shoreline for lakes, lagoons, and other water bodies.

Why Does This Matter?

Failing to disclose this information can be a costly mistake. Insurance companies may deny coverage due to inaccurate declarations. While including waterfront coverage adds a premium (typically 15-35% extra), it ensures you’re protected.

Avoiding Hassles:

If your property is near water, talk to your agent! Open communication prevents complications and ensures a smooth claims process should you ever need it.

Steer Clear of Bargain Basement Insurance: Protecting Your Mexican Home

The allure of a cheap insurance policy is understandable, but in the world of home insurance, “buyer beware” rings especially true. Here’s why:

Low Price, Big Problems:

Rock-bottom premiums often come with hidden costs. You might encounter:

- High Deductibles: This is the amount you pay upfront before the insurance kicks in. A super low premium might mean a hefty deductible, leaving you on the hook for a significant chunk of repair costs.

- Limited Coverage: Cheap policies may have major exclusions, leaving you vulnerable in certain situations.

- Financially Unstable Insurer: The cheapest company might not be around when you need them most. Look for a reputable insurer with a solid track record.

Understanding Risk and Price

Mexican insurance premiums are based on risk. Properties in high-risk zones (think earthquake or hurricane zones) will naturally have higher premiums. While Mexican insurance might be generally cheaper than the US or Canada, the difference shrinks in high-risk areas.

Invest Wisely in Peace of Mind:

Mexican home insurance works best with a smart approach. Here’s what you can do:

- Ask Questions: Don’t be shy! Understand the factors affecting your policy and coverage limits.

- Read the Fine Print: Review the policy details carefully to avoid any surprises later.

- Choose the Right Agent: A good agent will explain options and help you find the right fit for your needs.

Remember, your Mexican property is an investment. Don’t settle for inadequate protection. Take the necessary precautions to safeguard your home with a well-rounded insurance policy.

Included in Mexpat Realtors Buyers Agent Services y Property Management Services we request competitive quotes from 2-4 top insurance companies in the local area with sufficient coverages for your property type and needs.

Written by Mexpat Realtors – March 28, 2024

Para asuntos relacionados con Bienes Raíces en Puerto Vallarta, Casas en Venta en Puerto Vallarta, Condominios en Venta en Puerto Vallarta, Sayulita Real Estate, Zona Romantica Puerto Vallarta o los alrededores de Bahia de Banderas, Property Management Puerto Vallarta, o Rentas en Puerto Vallarta, Mexpat Realtors es un gran recurso.

Llámenos o contáctenos en línea en www.mexpatrealtors.com