The Bank of Mexico (Banxico) has voted to raise its benchmark interest rate by 25 basis points to a record high of 11.25% as it continues its fight against inflation.

The central bank’s key rate has now risen 725 basis points in the current tightening cycle, which began in June 2021.

Thursday’s unanimous vote by the five members of Banxico’s governing board comes a week after the national statistics agency INEGI reported that annual headline inflation was 7.12% in the first half of March, down from 7.62% in February.

While inflation also declined in February, the headline rate, or raw inflation rate, is still well above the central bank’s target of 3%, with tolerance of one percentage point in either direction.

Banxico has raised its benchmark rate at its last 15 monetary policy meetings, with Thursday’s increase being the smallest since November 2021.

In a statement announcing the 25-basis-point hike, the bank said that global inflation “remains at high levels” and noted that most central banks, including the United States Federal Reserve, have “continued raising their reference rates.”

However, the statement said, since Banxico’s last monetary policy meeting in February – at which the bank’s board members voted unanimously for a 50-basis-point hike – annual headline inflation in Mexico “has decreased more than expected.”

That decrease led most economists to correctly predict that the central bank would only lift its key rate by 25 basis points today.

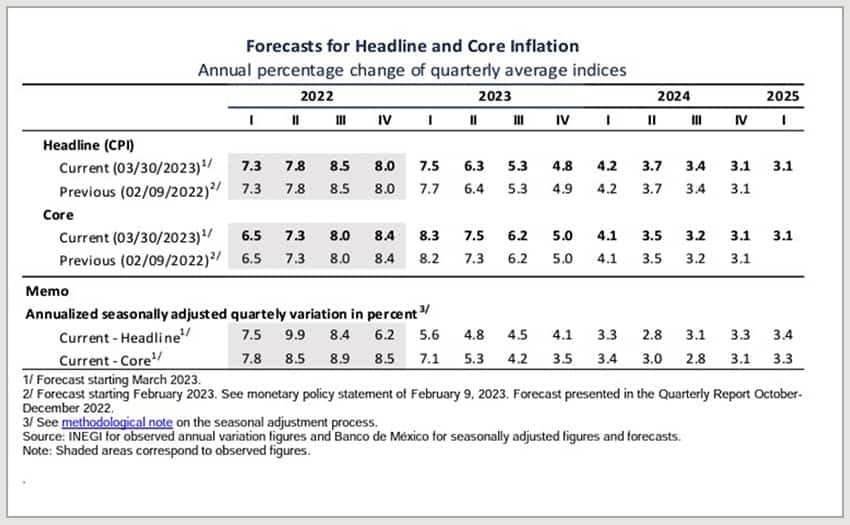

Banxico said that “inflation is still projected to converge to the 3% target in the fourth quarter of 2024” but noted that the forecast is subject to a range of risks, including persistence of core inflation at high levels, foreign exchange depreciation due to volatility in international financial markets and pressures on energy prices or on agricultural and livestock product prices.

For its next monetary policy decision on May 18, Banxico said its board members “will take into account the inflation outlook, considering the monetary policy stance already attained.”

In contrast to previous statements, the bank didn’t specifically mention the possibility of a rate hike at its next monetary policy meeting, suggesting that the 11.25% rate could remain unchanged through May.

Several banks, including Banorte and Scotiabank, predict that the benchmark rate at the end of 2023 will be 11.75%. Interest rate cuts are expected in 2024, provided that inflation is declining toward Banxico’s target rate.

The central bank is currently forecasting that annual headline inflation will decline to 4.8% in the fourth quarter of 2023. It predicts the headline rate will continue to fall through next year to reach 3.1% in Q4 of 2024.

Para asuntos relacionados con bienes raíces en Puerto Vallarta, o real estate in Bahia de Banderas, property management, buying houses in Puerto Vallarta, buying condos in Puerto Vallarta or the surrounding areas Mexpat Realtors in Puerto Vallarta is a great resource call them or go to their website www.mexpatrealtors.com for more information

Fuente: https://mexiconewsdaily.com/news/central-bank-raises-interest-rate-another-record-high/